It looks like the looming sword of crisis will not go easily from Pakistan. As per reports, foreign investors have withdrawn $263 million from debt securities. The move came following the Coronavirus pandemic.

[adinserter block =”3″]

The virus has affected thousands across the globe, including five in Pakistan. Owing to the virus stock markets around the world witnessed an abrupt decline.

Foreign investors have invested around $3 billion in the last eight months. The withdrawal may lead to a decline in Pakitan’s foreign reserves, which would be horrific for the already struggling economy of the country.

Dr. Reza Baqir on the ‘unexpected’ withdrawal!

Governor State Bank of Pakistan (SBP), Dr. Reza Baqir on Monday, asserted that the withdrawal was unexpected. He said that the outflow of $263 million was sudden and hasty.

Source: Urdu point

Moreover, the state bank has carried investigations to explore the global bent of financing by foreign businesses in sovereign securities. “We have put measures in place to reduce the risk (of outflow) and take maximum benefit of the investment. I just want to assure there is nothing to be worried about,” Dr. Reza said.

Moreover, since July 2019, foreigners have lent a total of $3.47 billion and withdrawn $313.93 million, as per SBP data.

BMA Capital Executive Director Saad Hashmi talked to a private news channel. He said, “the outflow is primarily due to the coronavirus emerging as a concern.”

Contrarily, the loan program of the International Monetary Fund’s (IMF) is going on the right track; the parity of rupee-dollar is stable, and the interest is high in the country.

“Nothing has changed on the ground domestically. International concern over the coronavirus has led to this reduction in foreign investment in the domestic sovereign debt securities,” he said.

[adinserter block =”4″]

Besides, he also talked about spike in the Pakistan Stock Exchange (PSX). He said, “The trend (foreign selling at the PSX) indicated that the outflow from debt instruments (T-bills) was due to the coronavirus concern.”

He indicated that foreigners will again invest if Pakistan successfully tackles the global pandemic of Coronavirus. “There is still room for attracting another few billion dollars in T-bills and Pakistan Investment Bonds (PIBs) if the virus is contained,” he said.

“This has happened for the first time that some investors have opted to divest their investments instead of reinvesting,” he continued.

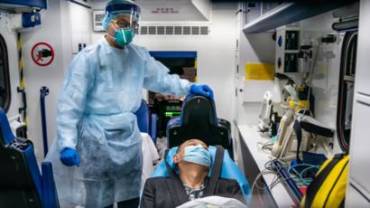

Coronavirus affecting the world!

The virus has impacted the world in various ways. China has witnessed an immense decline in her economic growth. Some saying it is biological warfare launched against China to dismantle her economy.

Source: BBC

Reportedly, the virus has reached to 60 countries till now. The virus has killed more than 3000 people, most of them in China. Also, more than 80,000 people are infected, globally.

However, China successfully tackled the virus and many infected people became healthy once again. This has resumed market activities in China. As of now, the activity is still slow as the virus is not completely controlled.

What should Pakistan do?

Apparently, Pakistan is struggling with its economy and still has a long way to go on financial stability. There are not many options for Pakistan. However, the country can control the virus by spreading knowledge about it to the common masses. Most importantly, Pakistan should request China to send those Doctors to Pakistan who successfully treated the virus to teach Pakistani doctors.

Besides, in the economic realm, Pakistan should remain calm and focus on internal matters. Pakistan needs to tackle the energy crisis and terrorism to yank foreign investment. Additionally, the country should continue trade policies as they are across the world.

[adinserter block =”10″]

Once the virus vaccines develop, the investment will come back to Pakistan. Till then, the outflow of $263 million will not make any significant impact.

What do you think of the withdrawal? Tell us in the comments section below!